Property account information

MyEsquimalt is an online payment platform that will allow you to access your township accounts 24 hours a day.

![]() Sign up to receive an electronic property tax notice (e-billing) and review your accounts.

Sign up to receive an electronic property tax notice (e-billing) and review your accounts.

Go to MyEsquimalt

Property tax calculation

For 2025, about 59 per cent of the taxes you pay goes to the municipality. Included in the taxes you pay are utility costs like sewer and refuse collection, rather than sending separate invoices to you. The remaining 41 per cent of taxes go to external agencies who set their rates independently.

These public agencies (e.g. CRD, BC Transit and Province of B.C.) affect the property tax rate and the amount of property tax collected by the township each year. While the township collects taxes on behalf of these agencies, it does not have control over the applicable tax rates.

It’s important to note that the township incorporates all utility costs into its property tax levies, whereas some municipalities send separate invoices to taxpayers.

This amount of municipal tax payable by a property owner is calculated as: (mill rate X assessed value)/1,000 .

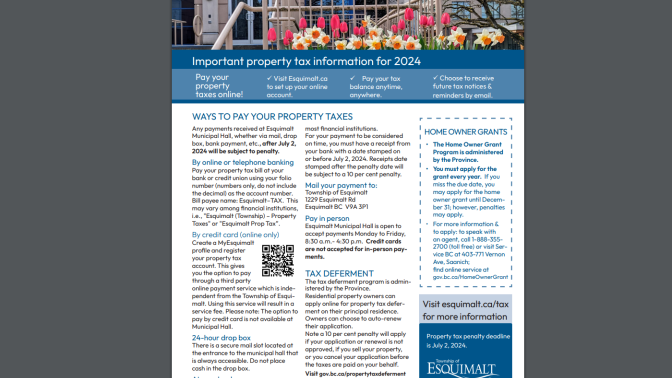

Property tax payments

See the several payment options available to you: see the details.

Mayor's message

Ways to pay your property taxes

Home owner grant

Property owners who occupy a property as their principal residence may be eligible for a Provincial home owner grant. Learn more on the Government of B.C. website. You must claim your home owner grant every year you are eligible.

Property tax notices

Property tax notices for the current year are mailed to property owners during the third week of May. Property taxes are due and payable on the first business day in July each year. You are responsible for the taxes on your property, even if you have not received a tax notice.

Outstanding taxes and penalties

A penalty of 10 per cent is applied to outstanding current year taxes at the close of business on the due date. Ensure that you claim your home owner grant each year to avoid a 10 per cent penalty on this outstanding amount. More

Property assessment

Property assessment in British Columbia is the responsibility of the British Columbia Assessment Authority. Any questions about the assessment of property in Esquimalt should be directed to BC Assessment. More

Your home's assessed value

BC Assessment has published the 2025 property assessments. You are able to appeal a property value included on your notice of assessment until January 31.

Changes in assessed value do not necessarily mean a change to property taxes. As indicated on your assessment notice, how your assessment changes relative to the average change in your community is what may affect your property taxes.

About property taxes

To balance the operating budget Council must raise revenue from property taxes. The amount required is converted to a rate, which is applied to the taxable assessment of each property and determines the amount of the property taxes payable.

Property tax rates (often called “mill rates”) are used to determine how much property tax you pay, based on the assessed value of your property. The tax rate applies to each $1,000 of net taxable value and the rate is different depending on the class of property you own.