Annual budget and 2025 property tax rates

Information bulletin

For immediate release

Each year, the township adopts an annual budget to fund important services used every day in our community. Each year, new tax rates must be set before May 15 to raise enough revenue from property taxes to fund the annual budget. There is a different tax rate for each property class in the municipality.

Overall property tax increases can be attributed to the (i) Council approved increase, (ii) the change in assessment value, and (iii) amounts collected by the Township on behalf of third-party agencies.

A 9.90 per cent increase was needed to fund the budget including core services, policing, infrastructure contributions and wages, amongst other costs. This increase represents an additional $328 in taxes to the average property in the township based on a residential property that experiences an average assessment value change. The average residential assessment value decreased by 0.40%. Businesses (Class 6) will see an average increase of $1,351 and had an average 2025 assessment increase of 5.49%.

Where your tax dollars go

The township is required to collect taxes on behalf of other taxing agencies, and in turn remits these taxes directly to them. About 59 per cent of the taxes you pay goes to the municipality. Municipal taxes also fund utility costs like sewer and refuse collection, rather than sending separate invoices to residents and businesses as is the practice in other municipalities.

The remaining 41 per cent goes to other agencies who set their rates independently. These include:

- Province of British Columbia (School Taxes)- 21%

- Capital Regional District- 12%

- Capital Regional Hospital District (Regional Hospital)- 2%

- Victoria Regional Transit- 5%

- BC Assessment Authority- 1%

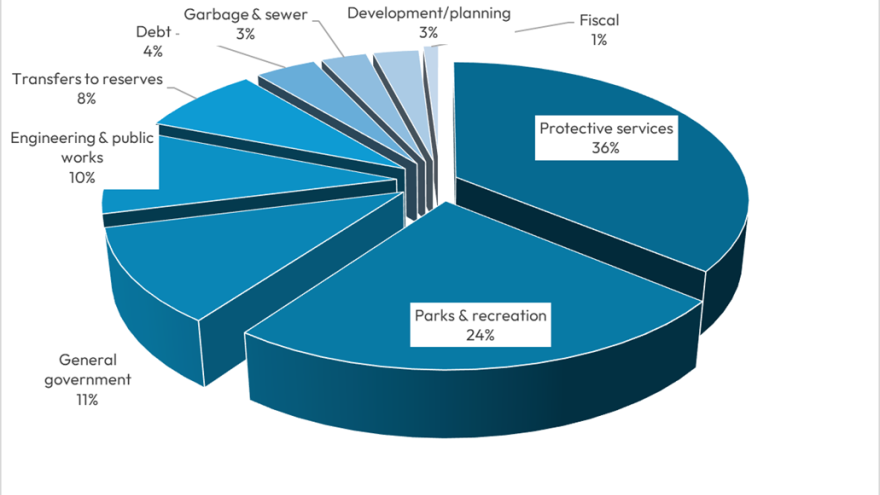

Operational budget allocation

The 2025 approved operating budget has protective services (fire, police) as the largest cost item.

Construction material and labour costs rose during the pandemic and continue to remain high. These elevated costs impact budgets and project planning. As such, Council eliminated or deferred some projects for this year to reduce budget needs.

To further reduce costs, Council did not fund the majority of supplemental requests, including most new staff positions. Council directed staff to reduce the proposed annual increase for infrastructure contributions from 3% to 1.5% to balance funding infrastructure into the future while taking into account the financial pressures faced by residents and businesses.

What is the budget increase of 9.9 per cent used for?

Esquimalt’s budget increase focusses on maintaining core municipal services, meeting wage and benefit obligations, funding policing per the Framework Agreement with City of Victoria, and contributing to infrastructure funding reserves.

What funds our budget?

Property taxes make up about 25 per cent of the township’s revenue sources.

The Payment in Lieu of Taxes from the Government of Canada is paid to account for the DND properties in the township. The amount paid each year is variable and plays an important role in Esquimalt’s revenue stream.

Funding for capital projects does not impact property taxes—capital projects such as active transportation infrastructure are paid for by grants when possible or out of reserve funds. Contributions to these funds are invested to add capital until they are used for a project.

Home owner grant

Property owners who occupy a property as their principal residence may be eligible for a Provincial home owner grant. Learn more on the Government of B.C. website. You must claim your home owner grant every year you are eligible.

The property tax deadline is July 2, 2025.

More information

###

Media contact

Tara Zajac

Manager of Communications

tara.zajac@esquimalt.ca

250-414-7122